Dangote Sugar Refinery Plc(DANGSUGAR) published its FY19 (audited) and Q1'20 results earlier today. The company recorded marginal growth (+1.8% YoY to N22.4 billion) in PAT in FY'19, while its Q1'20 after tax earnings declined by 9.0% YoY to N6.4 billion. Following the release of the FY'19 result, the company declared a dividend of N1.10 per share, which translates to a dividend yield of 8.5% on current price

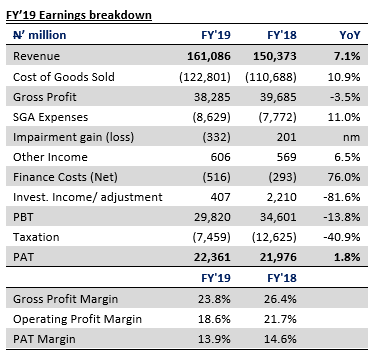

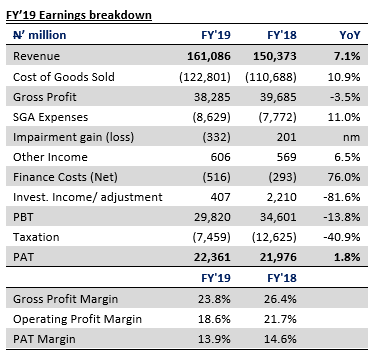

Highlights of FY'19 Audited Results

Highlights of Q1'20 Unaudited Results

Highlights of FY'19 Audited Results

- DANGSUGAR grew revenue by 7.1% YoY to N161.1 billion in FY'19, but still endured a 2.6ppts contraction in gross margin to 23.8% due to a 10.9% YoY increase in cost of sales. Pressures on the cost of sales front largely reflected a 15.1% YoY increase in the cost of raw materials

- Operating margins also declined by 3.2ppts YoY to 18.6% in FY'19 as higher administrative expense (+15.0% YoY to N7.8 billion) and a N332.2 million impairment loss (vs. N201.3 million gain in FY'18) added to the negative impact of cost pressures

- Net finance cost surged by 76.0% YoY to N516.2 million (largely reflecting a N214.3 million interest on lease payment and some exchange losses), compounding earnings pressure at the pretax level (-13.8% YoY to N29.8 billion). Pretax margin was also 4.5ppts lower YoY at 18.5% in FY'19

- However, after tax profit increased marginally in FY'19 due to a deferred tax income of N3.6 billion (vs. deferred tax expense of N283.3 million in FY'18)

- In Q4'19, earnings surged by 45.4% YoY to N7.7 billion after an N806.8 million tax write back (vs. tax expense of N3.1 billion in Q4'18) papered over operating profit weakness (-16.3% YoY) in the quarter

Highlights of Q1'20 Unaudited Results

- In line with the pattern in Q4'19 and FY'19, DANGSUGAR reported a strong revenue growth in Q1'20 (+24.9% YoY to N47.6 billion) but still suffered a 5.9ppts YoY plunge in operating profit margin to 22.6%

- Operating margin pressures mainly reflected higher cost of raw materials and increase in administrative expense

- Net finance expense surged to N1.4 billion in Q1'20 from N41.4 million in Q1'19 due to huge foreign exchange losses. Consequently, pretax profit declined by 11.1% YoY to N9.5 billion in Q1'20 with related margin at 20.0% (vs. 28.1% in Q1'19)

- Despite the P&L weakness, the company reported a strong cash balance of N40.0 billion in Q1'20 (vs. N21.8 billion in Q1'19) that was supported by some working capital efficiency