Nigeria Treasury Bills in 2026: High Yields, Heavy Demand, Strong Investor Appetite

Nigeria’s Treasury Bill market is off to a strong start in 2026, with robust investor participation and attractive yields continuing to position short-term government securities as one of the most compelling fixed-income plays in Africa’s largest economy.

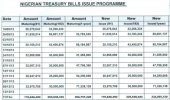

At the most recent Primary Market Auction conducted by the Central Bank of Nigeria (CBN), stop rates across all maturities remained elevated, reinforcing the appeal of risk-free government instruments in a high-yield environment.

Current Auction Stop Rates (February 2026)

- 91-Day Treasury Bill: 15.84%

- 182-Day Treasury Bill: 16.65%

- 364-Day Treasury Bill: 16.99%

These stop rates reflect the annualized discount yields at which successful bids were allotted.

Why Investors Are Paying Attention

High Short-Term Returns

High Short-Term Returns

With the 91-day bill offering nearly 16% annualized returns and the 1-year bill approaching 17%, Nigerian T-Bills remain significantly more attractive than most developed-market short-term instruments. For yield-seeking investors, especially institutions managing large liquidity pools, this presents a rare opportunity for strong risk-adjusted returns in short durations.

Strong Oversubscription Signals Confidence

Strong Oversubscription Signals Confidence

Recent auctions have seen massive oversubscription levels, with total bids far exceeding the amount offered. This indicates strong liquidity in the financial system and sustained demand from banks, pension funds, asset managers, and high-net-worth investors.

When demand consistently outpaces supply, it reinforces the depth and resilience of the market.

Institutional Backing

Institutional Backing

Pension Fund Administrators (PFAs) continue to allocate significant portions of their portfolios to Federal Government securities, including Treasury Bills. High yields relative to corporate debt and equities have made short-term sovereign instruments a preferred allocation for risk-conscious fund managers.

Stable Yield Curve Structure

Stable Yield Curve Structure

The current yield structure shows a modest term premium:

- 91-day: 15.84%

- 182-day: 16.65%

- 364-day: 16.99%

While the 364-day rate has softened slightly compared to prior peaks above 18–20% in late 2025, yields remain historically strong. The slight moderation may reflect evolving monetary expectations, but returns remain compelling.

What This Means for Investors

For domestic investors:

- Attractive short-term parking for idle cash

- Competitive alternative to savings and money market accounts

- Useful portfolio stabilizer during equity volatility

For foreign investors:

- High nominal yields

- Opportunity for carry trades (subject to FX risk considerations)

For institutional portfolios:

- Strong liquidity

- Predictable returns

- Sovereign backing

Key Considerations

Key Considerations

While yields are attractive, investors should continue to monitor:

- Inflation trends and real return dynamics

- Foreign exchange stability

- Monetary policy direction from the CBN

- Liquidity conditions across the banking system

Bottom Line

As of early 2026, Nigerian Treasury Bills remain a cornerstone of the country’s fixed-income market. Elevated yields, heavy oversubscription, and strong institutional participation make them one of the most enticing short-duration investment options currently available in the Nigerian financial landscape.

For investors seeking high yield with sovereign backing, Nigeria’s T-Bill market continues to deliver.